USDOT Agency Nixes Upgraded Rear Impact Guards

The National Highway Traffic Safety Administration (NHTSA) last month rejected that the agency mandate stricter upgrades to rear impact guards on semi-trailers.

Guest Editorial by Brett Sant

Volunteer Chairman, ICSA Board of Directors

If you are like many commercial auto insurance buyers, you probably really pay attention to those costs once a year when you shop for coverage. But you really should pay closer attention all year long because cost inflation in commercial auto coverage has been happening for over a decade, and small fleets feel the impact disproportionately to large fleets. Why do your insurance costs continue to rise?

The answer is really just basic economics. The demand for coverage has exceeded the supply of premiums used to pay claims going all the way back to 2011. Simply put, the number and cost of insurance claims has exceeded the amount of premium paid into the pool to pay losses. There are many reasons for this: increasing crash frequency; increased cost to repair damages; inflated medical costs; the impact of “nuclear verdicts”; litigation financing and a host of other “social factors” have yielded greater insurance losses and underwriters have not collected enough premium to cover the costs. The response of the insurance industry has been to increase rates. Commercial auto rates have increased quarterly for the past 40 quarters but increasing rates has not solved the financial problem.

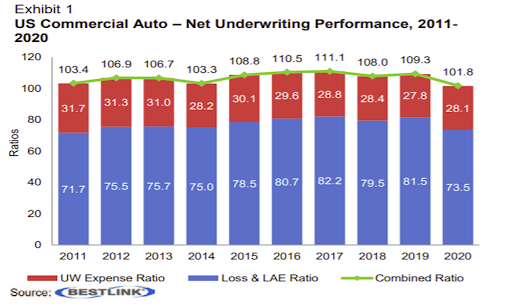

Insurance companies use a ratio to measure profitability. Costs are put into two buckets: losses (including defense and adjusting costs) and expenses. The two buckets of cost combined are referred to as the “Combined Ratio”. A Combined Ratio above 100 means that underwriters are not collecting enough premium to cover the costs. Insurance companies want to avoid underwriting losses. As you can see from the chart below, the Commercial Auto market has experienced underwriting losses every year going back to 2011.

So, premiums continue to go up. In theory, eventually - as rates rise - more insurance capacity enters the marketplace which in turn tends to bring down rates. Insurance companies do not rely solely on underwriting profitably to make money. In addition to underwriting profits, insurance companies generate investment income with their portfolio of earned premium. But in low interest rate environments like we have experienced for the past 20 years, insurance companies place a greater importance on underwriting results. Even additional capacity in the marketplace has not resulted in lower premiums, as underwriters try to bring premium in line with costs. The reason is that costs continue to rise at a greater rate than additional premium/underwriting capacity.

Carriers feel this impact when they apply for insurance coverage. Until losses are less than the amount of premium collected, you can expect your rates to continue to increase. While you can’t really increase the underwriting capacity, you can be part of the solution – and not by paying more premium into the pool!

How? Well, it is a very simple formula – reduce the number and severity of losses. Become the kind of risk the underwriters want to insure – you know, the one who pays premium and doesn’t have losses. Because if you are the other type of risk, the one who pays premiums AND generates excessive losses, you might find yourself paying rates you can’t afford, if you can find someone who will insure you at all.

So, the answer is quite simple – be safe. Invest in improving your safety results. Start by not referring to accidents as “accidents”. Refer to events as “crashes”, and presume that you can prevent most, if not all of them – even the crashes caused by the mistakes of other motorists. Fleet owners really must start with that mindset. Crashes need to be as unacceptable to you as not having a load to haul with your available tractor and trailer. In fact, as a fleet owner your mindset should be that you would rather park the rig than allow it to be operated unsafely.

Most people certainly are responsible and don’t want to have crashes – obviously you don’t want to have your rig wrecked in a crash and you certainly do not want to see people get hurt. You don’t expect that to happen to you. But wishing and hoping are not strategies. So, if you are really committed to lowering your risk profile and, by extension, your costs and thus making your business more profitable, what do you do?

Implement an effective safety plan and follow it in a disciplined way. Don’t trust to luck. What does an effective safety program look like? Well, there are certain principles or elements that decrease the likelihood of crashes within your fleet. And, if you are operating your own rig, there are safe driving practices you yourself can follow that will reduce risk. You will find these elements in the Model Safety Plan ICSA will soon introduce, along with First Gear, a proven online driver training tool that will soon be made available to ICSA members at no cost. Here are key components of a safe operation:

All these actions will cultivate a culture of safety. As more and more fleets get into this cadence of safety performance, the industry’s safety culture will improve, crashes will be reduced and insurance costs will follow. There is no shortcut to lower insurance costs – safety is the key!

Thank you for joining ICSA and taking this big step toward improving highway safety. Be on the lookout on our website for more tools and information to help you implement your own, effective safety program.

The National Highway Traffic Safety Administration (NHTSA) last month rejected that the agency mandate stricter upgrades to rear impact guards on semi-trailers.

Hurricane Katrina in 2005, and now Hurricane Helene in 2024, with Milton bearing down on the Gulf Coast! Major storms, with major disaster areas and the need for emergency supplies, most of which come by truck.

FMCSA is hard at work on a new online registration system, to “improve the transparency and efficiency of FMCSA’s registration procedures”.